The Lifetime Allowance (LTA) was introduced on 6 April 2006 as part of the pensions legalisation overhaul often referred to as “Pension Simplification”.

The Lifetime Allowance imposed an upper limit on the value of benefits that could be accrued within UK-registered pension schemes without a tax charge being imposed. Prior to the introduction of the Lifetime Allowance, no upper limit was in place and the main restriction with regard to the pension benefits that you could accrue was governed by a cap on the amount of contributions that could be paid in any given tax year.

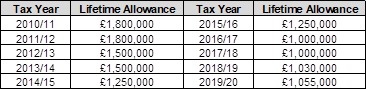

Initially, the Lifetime Allowance was set at £1.5m for the 2006/07 tax year, with successive increases announced from outset up to £1.8m for the 2010/11 tax year. Most commentators assumed that post-2011, the Lifetime Allowance would increase in line with inflation. What came as a surprise to most was the subsequent reductions to the allowance from 2012/13 onwards. The table below confirms the changes to the Lifetime Allowance since the 2010/11 tax year.

As detailed above, the Lifetime Allowance continued to reduce until the 2016/17 tax year. From 6 April 2018, the Lifetime Allowance increases annually in line with the Consumer Prices Index (CPI).

As many were affected by the drop in the lifetime allowance, various forms of transitional protection were introduced. It is no longer possible to apply for most of the protections introduced however, there are two that remain available to individuals at present. These are detailed below.

Fixed Protection 2016 (FP16) – Individuals with FP16 benefit from a lifetime allowance of £1.25M. To qualify for FP16, no benefits can be accrued post 5 April 2016, and the individual most not hold any previous transitional protections other than a form of individual protection (IP16 or IP14).

Individual Protection 2016 (IP16) – Individuals that do not have primary protection or IP14 can apply for IP16. Their pension benefits must exceed £1M or more on 5 April 2016. Benefits can still be accrued under IP16. The individual will have a lifetime allowance equal to the capital value of their pension benefits as at 5 April 2016, subject to a cap of £1.25M.

Many individuals will benefit from previous transitional protections that were introduced following the reductions made to the lifetime allowance. It is important to ensure that you do not unintentionally revoke these protections as your lifetime allowance would revert back to the standard allowance, presently £1.03M. If an individual held FP16 and inadvertently revoked the protection, this could result in an additional lifetime allowance tax charge of up to £121,000.